6 minutes

6 minutesProfitability recovers to pre-crisis levels, with improved operating performance across all businesses and progress of the Group’s strategic plan

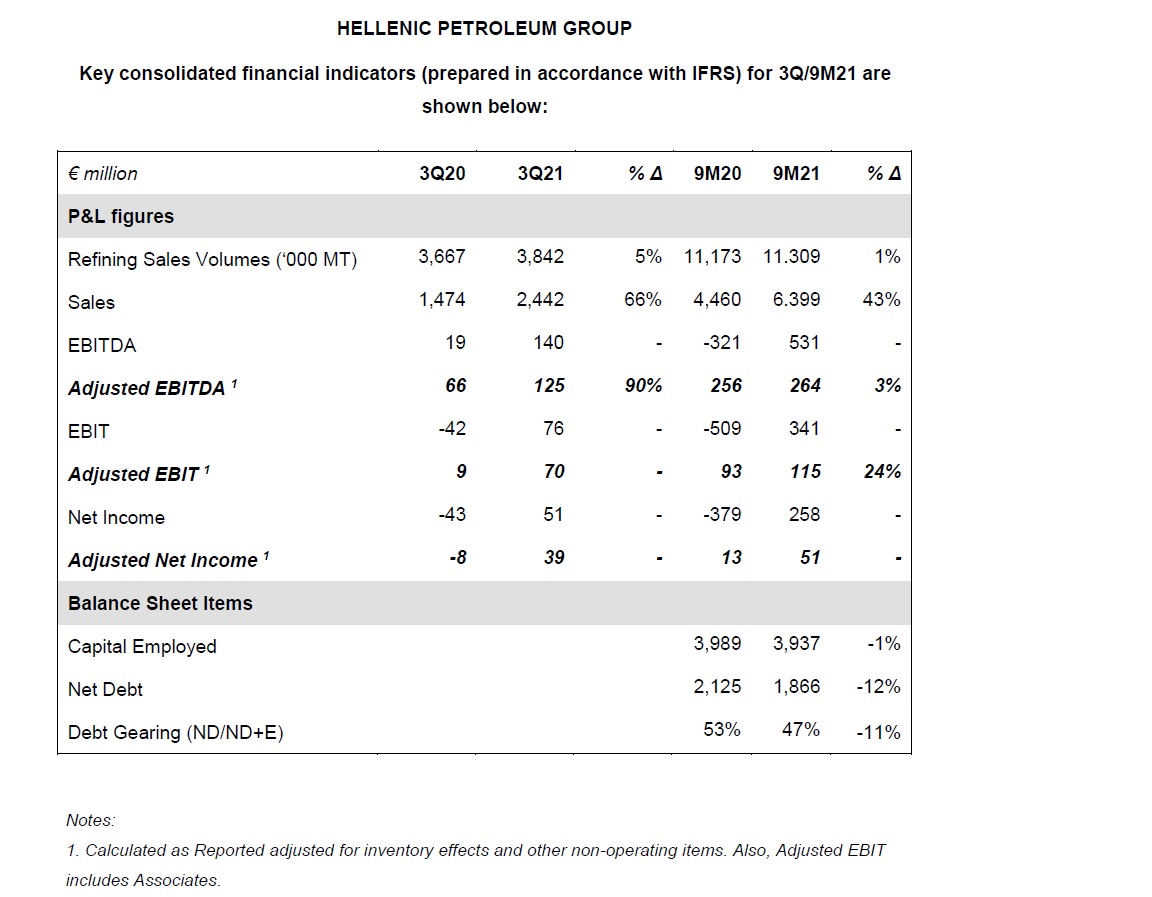

HELLENIC PETROLEUM announced its 3Q21 consolidated financial results, with Adjusted EBITDA coming in at €125m, up by 90% vs 3Q20 and 58% compared to 2Q21, with corresponding Net Income at €39m. Likewise, 9M21 Reported Net Income came in at €258m, improved by over €600m compared to last year.

Results were mainly driven by oil demand recovery in all key markets, as well as improved benchmark refining margins, following several quarters at historical lows. The strong operational performance in refining and marketing, both in Greece and internationally, as well as the first results from the strategic transformation programs, also had a positive impact. A significant part of the operational improvement was offset by the surge in energy costs and CO2 emissions allowance pricing, which has become one of the most important challenges for industries in Greece and internationally.

Refining, Supply & Trading increased its contribution to the highest levels of the last 5 quarters, led by the higher refining availability and the improvement in the international environment. Furthermore, fuel demand in Greece continued to increase, with domestic sales accounting for 50% of total sales, the highest since 2019. The above positive results were partially offset by the significant increase of variable operating costs, due to the sharp rise in international natgas prices to multi-year highs, which affected the pricing of electricity, as well as of CO2 emissions allowances.

Petrochemicals’ results continued to improve, as product demand exceeds current supply. In Domestic and International Marketing, where an expansion and upgrade plan at the retail network is being implemented, sales and profitability were higher.

The associated companies in the Power and Gas sector reported another quarter of improved performance, mainly due to the higher electricity demand.

IFRS Reported financial results were further improved, due to the continuous increase in crude oil and product prices, with 9M21 Reported EBITDA at €531m and Net Income at €258m.

Strategy and main developments

The Group’s corporate restructuring process continues, with the Company’s BoD approving, on 30 September 2021, the draft demerger deed for the hive down of the Refining, Supply & Trading and Petrochemical business to the new company. The deed is expected to be submitted for approval by the Shareholders’ General Meeting in early December and its implementation is expected to be completed in the beginning of 2022. The new corporate structure will have multiple benefits in terms of flexibility in developing and financing of new activities, risk management, as well as improving value transparency across the Group's activities’ portfolio.

Engineering works at the 204 MW PV park in Kozani are at the final stage, with 14 of the 18 parks -corresponding to 166 MW- already mechanically completed, while connection to the HV network and commercial operation are expected in 1Q22.

With reference to the sale process of DEPA Infrastructure (65% HRADF - 35% HELPE), in which the Group participated as a joint seller with the HRADF, Italgas was declared as preferred investor, with an offer of €733m, corresponding to €256m for HELLENIC PETROLEUM’s participation. The share purchase agreement is expected to be signed soon, following the Court of Audit approval, while it is anticipated that the transaction will be completed in 1H22, subject to customary regulatory approvals.

Finally, during 3Q21, the on-shore exploration concessions "Arta-Preveza" and "NW Peloponnese" were returned to the Greek State, while in October the Hellenic Hydrocarbons Resources Management Agency was notified about the intention to also return the West Patraikos concession.

Andreas Shiamishis, Group CEO, commented on results:

“Economic recovery accelerated during 3Q21, mainly due to stronger tourism and increased economic activity, with a direct impact on our sector. The Group results are improved in almost all respects vs last year as a result of better environment and, more importantly, the continuous and steady improvements in controllable areas, such as refining availability, commercial performance in Greece and our international subsidiaries, as well as cost control.

However, aside those positive developments, the ongoing global energy crisis, with a sharp increase in international NatGas prices and a corresponding rise in -natgas linked- electricity and CO2 pricing, affects the industry and the energy transition process.

The above highlight further the importance and necessity of the Group’s strategic transformation process and the implementation of "VISION 2025" strategy, with the new corporate structure, a corporate governance upgrade, as well as the significant resources and capital reallocation, in order to grow in new energy market and proceed with the equally important decarbonization of our core activities”.

Benchmark refining margins improvement

Since the end of July, OPEC ++ has agreed to a gradual increase in crude oil exports, by 400 kbpd, with a significant impact on global crude supply. However, as demand continued to recover from COVID-crisis lows at a faster pace, a further increase in international prices was recorded, with Brent crude averaging $73/bbl, up from $43/bbl last year and $69/bbl in 2Q20.

As a result of higher demand, the main product cracks recovered from their recent historical lows. In addition, the increase in the crude oil supply, particularly for high-sulfur, put pressure on the relative pricing of those grades vs Brent, with the Brent-Urals differential at the highest levels of the last decade. Those led to a recovery in benchmark refining margins, with the FCC averaging at $5.2/bbl and Hydrocracking at $2.9/bbl. Finally, energy costs increased significantly, with gas and power prices reaching historical high.

The US dollar slightly strengthened vs the Euro in the 3Q21, with €/$ exchange rate averaging at 1.18, corresponding to last year's levels.

Domestic fuel market demand continuous improving

The lifting of mobility and travel restrictions as well as the restart of the economy and tourism during the quarter, resulted in ground fuels demand increasing by 8% vs LY, reaching 2019 levels. Total domestic fuels market demand amounted to 1.6m MT, -1% compared to 3Q19. The Aviation and Bunkering market also recorded a significant recovery compared to last year, with the consumption of shipping fuels up by 28% to 712k MT and aviation fuel more than doubling to 476k MT, but falling short of 2019 by 20%.

Reduced financing cost; €201m Eurobond repayment

On 14 October 2021, the Group repaid the remaining €201m bonds through available cash, while it will review its capital structure and opportunities in international markets, following the completion of HELLENIC PETROLEUM’s demerger process. The repayment of 4.875% interest rate bonds will have a positive impact on the Group's financing cost, which in 3Q21 amounted to €24m, reduced by 4% compared to last year.

In addition, a consent solicitation process is underway to the holders of October ’24 notes, to amend the existing conditions, so that the demerger of HELLENIC PETROLEUM takes place in a credit neutral way. Net Debt amounted to €1.8bn, significantly reduced vs LY and at similar levels vs 2Q21.

Key highlights and contribution for each of the main business units in 3Q21 were:

REFINING, SUPPLY & TRADING

- Refining, Supply & Trading 3Q21 Adjusted EBITDA at €57m

- Production amounted to 3.6m MT (+9%), due to the Aspropyrgos increased availability. Sales amounted to 3.8m MT (+5%), with domestic market up 13%, at 1.1m MT.

- HELPE realized margin at $8.7/bbl, the highest in two years, driven by stronger benchmark refining margins, as well as by the Supply and Marketing performance.

PETROCHEMICALS

- PP benchmark margins, even lower compared to 2Q21, remained at high levels, leading Adjusted EBITDA to €21m (+40%) in 3Q21 and €102m in 9M21, double vs 9M20.

MARKETING

- In Domestic Marketing, the recovery in fuel demand in all sub-markets resulted in increased sales volumes and profitability to significantly higher levels, offsetting the notable rise in transportation and electricity costs, with 3Q21 Adjusted EBITDA at €29m (+68%).

- In International Marketing, the sales’ increase in the retail networks and the good operational performance led the 3Q21 Adjusted EBITDA to €20m (+15%).

ASSOCIATED COMPANIES

- DEPA Group contribution to 3Q21 consolidated Net Income amounted to €3m.

- Elpedison's EBITDA for the 3Q21 came in at €20m (+31%), with 9M21 at €64m (+50%), due to increased demand for power as well as the contribution of NatGas plants in the system mix, offsetting the decline in profitability in the retail sector.