8 minutes

8 minutes

Positive FY20 results, despite COVID-19 crisis and worse refining environment in history.

Significant progress in implementing an energy transition strategy

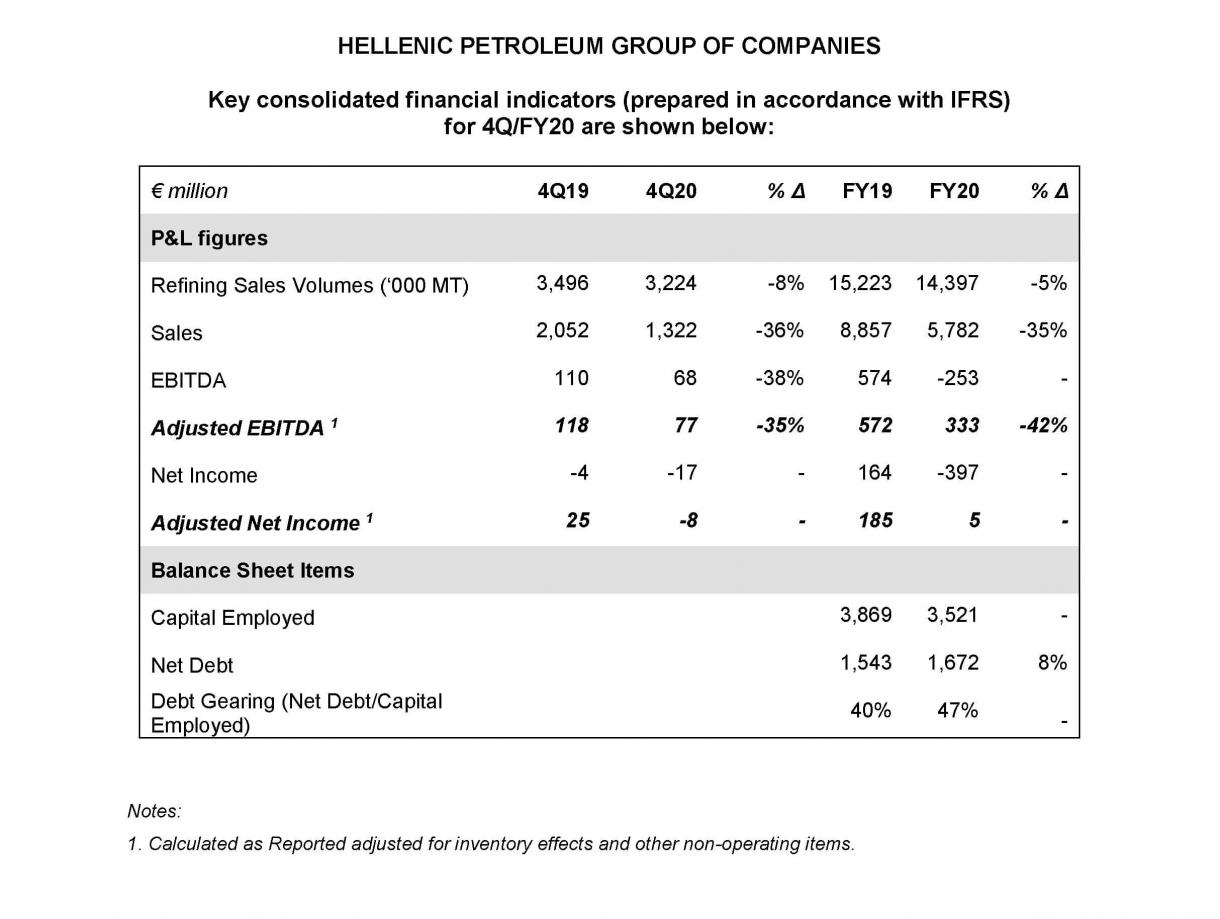

- Positive results for the Group during the pandemic. FY20 Adjusted EBITDA at €333m and Adjusted Net Income at €5m.

- Adverse environment, due to market shrinkage and historical low benchmark margins, but also an increase in exports by 11%. High production levels of the refineries.

- Successful completion of the largest maintenance turnaround and upgrade program of the Aspropyrgos refinery. Significant investments and improvements with benefit to the environment.

- Taking advantage of the international commodity markets and benefit from storage/contango trades to the order of $70m.

- €295m total capital expenditure for the implementation of the operational planning. Acquisition and development of the flagship project for RES in Kozani.

- Liquidity improvement and refinancing of existing credit facilities with privileged terms. Finance costs at historical lows.

- Proposal to the AGM for distribution of a dividend of €0.10/share.

HELLENIC PETROLEUM Group announced its 4Q/FY20 financial results, with Adjusted EBITDA coming in at €77m in 4Q20, with FY20 Adjusted EBITDA at €333m and Adjusted Net Income at €5m.

Overall results are considered satisfactory, as they were achieved amid the unprecedented drop in demand and benchmark refining margins, as well as successive lockdowns; impact on operating profitability over €350 million, while inventory losses, due to the drop of crude prices, exceeded €500m.

Since the beginning of the crisis, our key priorities have been the health and safety of staff and contractors, the uninterrupted supply of markets and our customers, as well as ensuring liquidity and taking advantage of market opportunities.

In this context, as early as February 2020, the Group implemented policies to protect staff, including testing with over 30,000 COVID-19 tests in total during the year and received the "CoVid-Shield" certification at Excellent level, for its facilities and offices, in all countries of operation. These measures helped to detect and isolate COVID-19 cases amongst staff and allowed the uninterrupted operation of the refineries, tank depots and petrol stations, supporting a normal market supply. At the same time, our refineries maintained high production levels, with exports 11% higher in FY20, at a time when many refineries in the Med region and globally, were forced to either curtail or shut down production runs.

Liquidity was improved with refinancing of existing credit facilities as well as obtaining additional funding for risk management purposes and investments. Taking advantage of the international commodity markets in crude oil and products and the substantial tankage capacity, the Group entered and benefited from storage/contango trades to the order of $70m in 2H20.

IFRS Reported Results benefited from the recovery of crude oil price in 4Q20, with inventory gains of €32m, reversing a small part of the losses recorded during the previous quarters. 4Q20 Reported EBITDA was €68m, vs €110m in 4Q19.

Supporting the national effort and society to deal with the pandemic, was also a priority for the Group, with substantial contribution in infrastructure and advanced medical equipment for the National Health System, totaling €8m.

Furthermore, during 2H20 we completed successfully the full (5-year) maintenance turnaround and upgrade program of the Aspropyrgos refinery; the largest turnaround project in the history of the Group, amid significant challenges due to the pandemic. In addition to the financial performance uplift, the refinery will also benefit from improved environmental performance in energy efficiencies and emissions reduction (PM) by 50%, as more than €35m were invested in environmental projects.

Total capital expenditure during the year was approximately €295m, covering the entire range of activities with an emphasis on energy transition and digital transformation projects. During the year, the Group proceeded to the acquisition and development of a 204MW PV project in Kozani, a milestone for the implementation of Group’s strategy in RES. It is noted that 20% of the total investments relate to sustainability and environmental improvement projects, with the corresponding share for 2021 exceeding 35%, marking the Group’s gradual transition to cleaner forms of energy, while also improving the environmental footprint of its core business.

The BoD, considering the results, as well as the outlook for the Group, proposed to the AGM the distribution of a FY20 dividend of €0.10/share.

Andreas Shiamishis, Group CEO, commented on results:

"This year was marked by COVID-19 pandemic and its consequences globally for all of us, with a particularly negative impact on the refining industry. As was the case for all, we faced significant challenges in maintaining safe operations and protecting our staff; however, on top of that we had to deal with a negative impact on operating profitability in excess of €350m, driven by demand drop and the lowest ever refining margins.

In this unprecedented environment, we focused on the protection of our staff and contractors, we managed to reduce the impact of the pandemic on our operations and ensured uninterrupted market supply. In addition, we maintained production at high levels and increased our exports, at a time where many refineries were reducing or even ceasing operations.

The safe and successful completion of the maintenance and upgrade program at Aspropyrgos refinery was a particular challenge, due to its scope and COVID-19 challenges arising from having over 2,500 people in the refinery on a daily basis. However, the economic benefit and environmental improvement are expected to be substantial from 2021.

As one of the largest companies in Greece, we considered it our duty to support the national effort to deal with the effects of the pandemic, with substantial contributions to the National Health System in Greece and in other countries where we operate.

Looking forward, strategic priorities along the clean energy transition and digitalization agenda were also progressed. Key milestones were the completion of the acquisition of the PV plant in Kozani, its financing with favorable terms with EBRD being an anchor investor, and the start of the construction during a very difficult period in the area. Investments in energy transition projects will gradually increase in the coming years, supporting our objective to improve our carbon footprint by 50% during this decade.

Leaving a most difficult year for all behind us, we remain cautiously optimistic as we expect conditions to start improving in the coming quarters. In that context, despite an exceptionally challenging year, the BOD will propose to the AGM a dividend of 0.10 cents per share which reflects our commitment to the shareholders and the positive outlook for the medium term.

These achievements reflect strong team effort and commitment of all our employees in the Group, who successfully responded to those exceptional operating conditions and I would like to thank them for their substantial contribution”.

Strategy implementation - Key developments

During 4Q20, the construction works at Kozani PV plant commenced, according to schedule, despite the small delays due to COVID-19. Furthermore, a Stakeholder Engagement Plan was introduced and implemented, in order to maximise the benefit for the local community.

Regarding the HRADF sale process of DEPA Infrastructure and DEPA Commercial (65% HRADF – 35% HELLENIC PETROLEUM), in which the Group participates as joint seller for DEPA Infrastructure and potential buyer for DEPA Commercial, due diligence is in progress by qualified parties, with binding bids scheduled for March 2021; however, delays in the process are expected due to COVID-19.

During 4Q20 the upgrade program at ELPEDISON’s Thessaloniki CCGT plant was successfully completed; following the €20m project, capacity increased to 420MW, while its efficiency and flexibility were also significantly improved.

Recovery of crude prices, weak refining environment, stronger euro

International crude oil prices recovered during 4Q20 from multi-year lows recorded in 2Q20 due to the demand collapse, following the lockdowns, reflecting mainly the result of OPEC++ agreement for the significant reduction of production and sales. As a result, Brent prices averaged at $44/bbl, substantially weaker vs 4Q19 ($63/bbl). Equally on a FY basis, prices moved higher from the lows recorded in April 2020, with Brent averaging at $42/bbl, vs $64/bbl in 2019.

The Euro recovered during 2H20, with its exchange rate vs the USD at 1.19, the highest since 1Q18; in FY20, the Euro averaged at 1.14 vs 1.12 in 2019. A weaker USD has a negative effect on European refiners.

The international refining environment deteriorated significantly during 2Q20, due to the sharp drop in demand, which recorded a small recovery in 2H20, remaining however materially lower vs 2019 levels. In 4Q20 main product cracks remained very weak, while the Brent-Urals spread improved slightly. Consequently, Med benchmark margins had a small recovery q-o-q, however close to historical lows, with FCC margins averaging at $1.0/bbl and Hydrocracking margins at $-0.1/bbl.

Significant demand drop in domestic fuels market

Domestic fuel demand in FY20 was down 8% at 6.3m MT, as auto-fuels were 13% lower on average during the year, due to the mobility restrictions, while heating gasoil consumption increased by 15%, reflecting weather conditions and the lockdowns imposed. Aviation and bunkering fuels demand was significantly lower, by 67% and 33% respectively, as tourism declined sharply and coastal marine and cruise sectors activity was also weaker.

Sufficient liquidity with successful refinancing of bank loans. Finance costs at historical lows

The Group improved its liquidity, despite the adverse environment, with additional funding from international capital markets, as well as the banking system, with improved terms, during the year. In 4Q20, the refinancing of €900m credit facilities maturing in 4Q20/1H21 was completed, improving the Group’s maturity profile.

The above led to a further significant reduction of finance cost, which came in at €104m, 10% lower y-o-y, having recorded an almost 50% decline in the last four years. FY20 Net Debt stood at €1.7bn, with gearing ratio at 47%.

Key highlights and contribution for each of the main business units in 4Q/FY20 were:

REFINING, SUPPLY & TRADING

Refining, Supply & Trading 4Q20 Adjusted EBITDA at €43m (-43%).

- Net production amounted to 3m MT (-5%), with sales at 3.2m MT (-8%), with FY20 at 13.8m MT and 14.4m MT respectively.

- Realised HELPE system margin came in at $6.6/bbl in 4Q20, maintaining significant over-performance vs benchmarks.

PETROCHEMICALS

- 4Q20 Adjusted EBITDA came in at €10m (-49%), as the reduced propylene output, due to the maintenance of the splitter unit at the Aspropyrgos refinery had a negative impact on profitability.

MARKETING

- In Domestic Marketing, while the implementation of the second lockdown in Greece, combined with the continuing decline in the aviation & bunkering market, led to lower volumes, improved operational performance and cost management kept 4Q20 profitability at the same level y-o-y. 4Q20 Comparable EBITDA came in at €10m and FY20 at €38m (-49%).

- In International Marketing, weaker demand in all markets was offset by improved operation that limited profitability drop, with 4Q20 Comparable EBITDA at €16m (-3%), leading FY20 at €59m (-8%).

ASSOCIATE COMPANIES

- DEPA companies’ contribution to consolidated Net Income for FY20 was €21m.

- ELPEDISON EBITDA amounted to €44m in FY20, a significant increase vs last year, due to higher production and supply optimisation.

View here the above table on pdf