5 minutes

5 minutesStrong operating results reflecting strong benchmark refining margins and improved refining operations;

Marginal IFRS profits on account of falling crude oil price

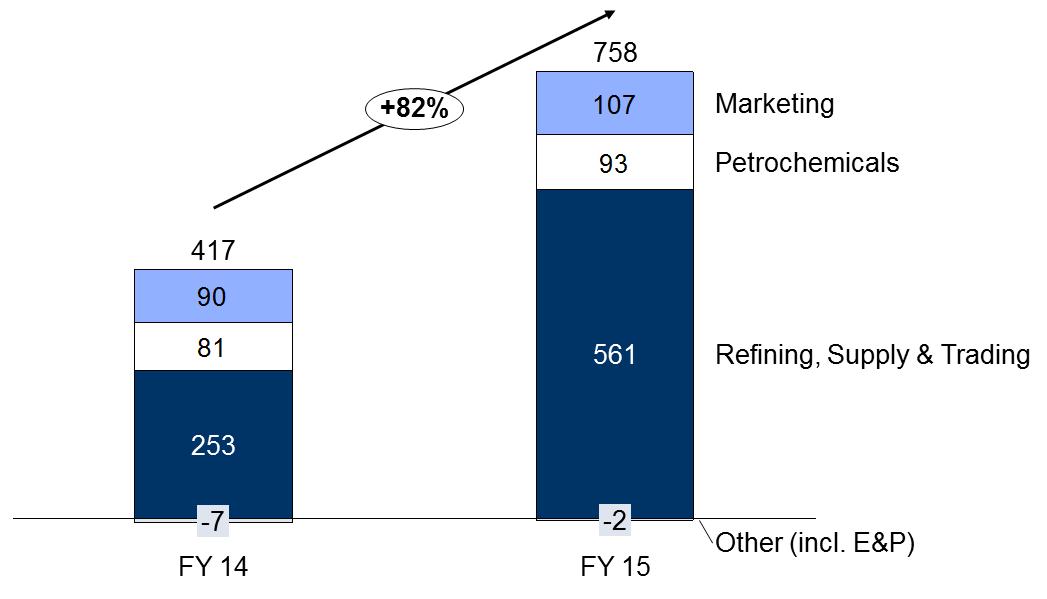

HELLENIC PETROLEUM Group reported yet another strong quarter for 4Q15, with FY Adjusted EBITDA reaching €758m, the highest on record, while Adjusted Net Income amounted to €268m. Improved performance from all business units; however, Refining, Supply & Trading was the key driver, with Adjusted EBITDA more than doubling on a continuing favorable international refining environment and improved refineries operation, post the completion of the extended maintenance schedule in the second quarter of 2015 and improvements in the supply chain with positive impact on results.

Marketing companies in Greece increased sales and profitability, as the transformation program KORYFI and competitiveness improvements reduced administrative fixed costs and provided for more efficient commercial operations. International subsidiaries also recorded improved results, on the back of synergies with refining and improved local market conditions.

Petrochemicals benefited from increased vertical integration following recent investments, which combined with improved margins, led to a record high profitability.

Sales revenue and reported results, were affected by the decline in crude oil prices for a second consecutive year, with inventory losses exceeding €300m (2014: loss of €484m). Despite the challenging economic environment, Group’s finance costs were reduced by 7% y-o-y, following the Eurobond issues in 2014, while Net Income came at €45m for the year (2014: loss of €369m).

Positive results strengthened the Group’s financial position, allowing it to overcome the challenging domestic environment during the year, as well as to take advantage of opportunities in the market (contago trades, alternative supply crude sources). Advanced planning and effective crisis management during the bank holiday and capital controls period, ensured the smooth operation of refineries and the uninterrupted supply of the market, thus mitigating the impact on the performance of the Group.

Adjusted EBITDA per business unit (€m)

Further crude oil price drop in 4Q15

Global oil supply surplus continued in 4Q15, while OPEC reiterated its policy to maintain production unchanged as communicated in 2014; coupled with the anticipated return of Iranian crude in the market drove prices to new lows. Brent crude oil price averaged $45/bbl, while in the first days of January prices dropped below $40/bbl, the lowest since 2004.

US dollar remained at the same level for third consecutive quarter at 1.09, significantly lower versus last year.

Crude oil oversupply, coupled with the increased global demand for gasoline and naphtha, resulted in healthy benchmark refining margins for the year, despite the fourth quarter drop. 2015 benchmark Med FCC margins averaged $6,5/bbl (2014: $3,3/bbl), with Hydrocracking margin at $6,5/bbl (2014: $3,9/bbl). It is noted that on an annual basis, Group’s refineries process on average 100-110m barrels of crude oil feedstock.

Demand growth in domestic fuels market

Domestic fuels demand in 2015 amounted to 8.6 million tones, according to preliminary official market data, recording a 5% growth y-o-y, mainly on account of the significant heating gasoil demand increase (+43%). Sales of motor fuels rmained at similar levels as last year, with diesel gaining 3%, offsetting corresponding losses in gasoline..

Strong operating results

4Q15 Group Adjusted EBITDA came in at €184m, reflecting increased contribution from stronger refining margins, operations and supply optimization. Production increased, with exports growing to 2.2m tonnes, 53% of total sales. Marketing business, both in Greece and international, also improved profitability.

The continued drop in crude oil and product prices resulted in inventory losses of €148m, leading 4Q15 Reported EBITDA to €31 while Net Result amounted to -€60m.

Stronger operating cashflow for another quarter allowed the increase in quantity and types of crude oil stocks, enabling further performance optimization opportunities and refineries feedstock blending. Net Debt came in at the same levels as in previous year (€1.1bn), with gearing at 39%. With respect to 2016 loan maturity schedule and considering current bond markets conditions, the Group plans to repay the $400m Eurobond through cash balances and existing credit lines. Although, strong results support further deleveraging, the Group plans a return to international capital markets to secure additional capacity and funding mix optimisation as soon as conditions allow.

On 22 January, following deliberations and the lifting of EU/US sanction on Iran, HELLENIC PETROLEUM and the National Iranian Oil Company (NIOC) have reached a framework agreement for the recommencement of the commercial relationship between the two parties. Furthermore the agreement provides for the gradual settlement of payables from 2011/12, before sanctions were implemented. The agreement offers access to an important crude supplier in the region.

The regulatory approval process for the sale of 66% of DESFA shares to SOCAR, is in progress. In the context of actions for the change of transaction structure in order to become acceptable to the European regulatory authorities, a due diligence is in process from parties interested to participate in the transaction alongside SOCAR.

Exploration and Production in Greece

On 4 February 2016, following a relevant tender by the Ministry of Environment & Energy, HELLENIC PETROLEUM was selected as the preferred bidder for the lease of Arta-Preveza and NW Peloponnese areas in West Greece. As far as the West Patraikos Gulf area is concerned, geophysical studies with extended 3D seismic surveys have been completed. HELLENIC PETROLEUM is acting as operator in a JV with Edison International SpA for this area.

Key highlights and contribution for each of the main business units in 4Q15 were:

REFINING, SUPPLY & TRADING

Domestic Refining, Supply & Trading 4Q15 Adjusted EBITDA at €144m.

Production exceeded 4.2 million tonnes, on increased utilisation of all units, resulting in sales growing to 4.1 million tonnes.

White products’ yield at 89%, despite a “heavier” crude mix.

DOMESTIC MARKETING

Domestic Marketing Adjusted EBITDA at €3m, with significantly increased sales volumes (+14%) mainly driven by heating gasoil and bunkering fuels.

Retail and C&I strengthened their market position and continued to gain market share, despite the economic downturn.

The Group has agreed with BP plc to extend the right to use the BP brand for ground fuels in Greece until the end of 2020, with the option of additional 5-year renewal.

INTERNATIONAL MARKETING

International Marketing improved profitability with Adjusted EBITDA at €14m, mainly on the back of sales volumes growth in most markets where the Group operates.

- In 2015 the sustained increased in subsidiaries’ integration with the Group refining system contributed to improved profitability.

PETROCHEMICALS

- Strong PP margins and significantly higher contribution from Thessaloniki PP plant led Adjusted EBITDA to €25m.

ASSOCIATED COMPANIES

DEPA Group contribution to consolidated Net Income came at €6m, with higher volumes on increased demand from gas-fired electricity generators..

Elpedison EBITDA at €19m on increased production.

Key consolidated financial indicators (prepared in accordance with IFRS) for 4Q and FY 2015 are shown below:

€ million. |

4Q14 |

4Q15 | % Δ |

|

FY14 |

FY15 | % Δ |

P&L figures |

|

|

|

|

|

| |

Refining Sales Volumes (‘000 ΜΤ) | 3.981 | 4.070 | 2% |

| 13.538 | 14.258 | 5% |

SALES | 2.383 | 1.803 | -24% |

| 9.478 | 7.303 | -23% |

EBITDA | (206) | 31 | - |

| (84) | 444 | - |

Adjusted EBITDA1 | 171 | 184 | 8% |

| 417 | 758 | 82% |

Net Income | (228) | (60) | - |

| (369) | 45 | - |

Adjusted Net Income1 | 52 | 65 | 24% |

| 2 | 268 | - |

Balance Sheet Items |

|

|

|

|

|

|

|

Capital Employed |

|

|

|

| 2.870 | 2.913 | 1% |

Net Debt |

|

|

|

| 1.140 | 1.122 | -2% |

Debt Gearing (ND/ND+E) |

|

|

|

| 40% | 39% | - |

Notes:1. Calculated as Reported adjusted for inventory effects and other non-operating items.

Note to editors:

Founded in 1998, Hellenic Petroleum is one of the leading energy groups in South East Europe, with activities spanning across the energy value chain and presence in 7 countries.

Further information:

V. Tsaitas, Investor Relations Officer

Tel.: 210-6302399

Email: [email protected]