6 minutes

6 minutesPositive operating results maintained, despite most adverse refining environment on record and COVID-19 impact; successful completion of Aspropyrgos refinery turnaround

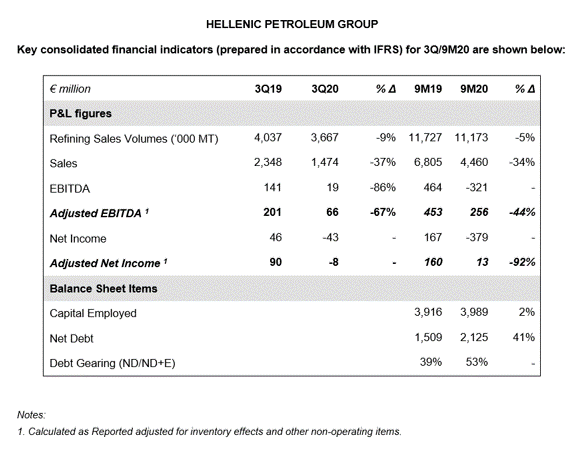

HELLENIC PETROLEUM announced its 3Q20 consolidated financial results, with Adjusted EBITDA coming in at €66m in 3Q20 and €256m in 9M20.

In terms of 3Q20 business environment, the significant decline in refining margins to negative levels on average, combined with the lower domestic market demand and the stronger euro, led to the worse international refining backdrop historically. Furthermore, the requirement for additional health & safety measures in facilities due to the pandemic was a key challenge. Increased product inventory levels, as well as reduced output and availability of crude oil combined with slow demand recovery, drove benchmark refining margins to negative levels, the lowest ever on record. The protracted low margin environment leads to adverse economics for a number of refineries globally, as well as the Med region, with some of them ceasing operations temporarily or permanently, or converting to other activities. In terms of the domestic market, auto-fuel demand recovered from 2Q20 lows, however remains materially below last year’s levels, especially in aviation and bunkering.

In these exceptionally challenging conditions and despite the 5-year full turnaround of Aspropyrgos, our refineries maintained high utilization levels. Total sales amounted to 3.7m MT (-9%), due to the domestic market drop, being sharper in aviation and marine fuels, while exports were up, as inventory management and realization of contango trades contributed to smooth market supply, with significant economic benefits.

With regards to the financial results in accordance with IFRS, the drop in crude oil and product prices towards the end of the quarter resulted to inventory valuation losses of €42m, with Reported EBITDA at €19m.

Strategy and main developments

Benchmark refining margins recorded small recovery in 4Q20, as high product inventory levels gradually clear, mainly due to lower refining production. In any case, international margins remain significantly lower vs the average of previous years, while demand recovery is expected to be negatively affected by the new lockdown measures in Europe.

Aspropyrgos Refinery has successfully and safely completed a shut-down for its 5-year full turnaround, with a total cost of more than €130m, focused on environmental and safety upgrade projects.

On 12 October 2020, HPF plc, a fully owned subsidiary of HELLENIC PETROLEUM, completed a €99.9m retap on its existing Oct ’24 notes, through private placement, with a 2.4% yield. EBRD contributed 75% of the issue proceeds that will be used for the development and construction of the 204MW PV project at Kozani, North Greece. It is noted that the acquisition was completed on 1 October and construction is scheduled to start in November.

Furthermore, regarding the sale procedures of DEPA Commercial and Infrastructure, in which HELLENIC PETROLEUM participates, due diligence procedures are in process, with binding bids scheduled for March 2021.

Benchmark refining margins at the lowest ever

Crude oil prices averaged $43/bbl, significantly lower than last year, having recovered from the multi-year lows recorded in 2Q20, following the OPEC++ countries agreement for the control of crude oil production and exports. This resolution had a negative impact on the availability and pricing of high sulphur grades, affecting European refineries.

Main product cracks remained at particularly low levels, with diesel dropping further to all-time lows, as the collapse in aviation fuel demand led to an adjustment of yields, increasing diesel output and resulting in surplus inventories. Furthermore, Urals pricing higher than Brent, combined with the above, led benchmark refining margins to historically low levels. FCC margins averaged at $0/bbl, with Hydrocracking margins at $-0.9/bbl.

The euro strengthened vs the US dollar to the highest levels of the last two years, with €/$ exchange rate averaging at 1.17 for the 3Q20.

Domestic fuel market demand decline

Domestic demand was affected mainly by the reduced economic activity in sectors like tourism, where the pandemic and measures to control it had a negative impact. More specifically, domestic ground fuels demand was 8% lower y-o-y, at 1.5m MT. The decline was larger in the aviation and shipping fuels market (-49%), with aviation fuel demand recovering q-o-q, however remaining materially lower vs 3Q19 (-63%).

Strong balance sheet, reduced financing cost

The Group continued to improve its capital structure, despite the particularly adverse environment, drawing additional liquidity, from both international capital markets as well as the Greek banking system, with very favorable terms. During 4Q20, the Group expects to conclude negotiations for the refinancing of €900m of credit facilities maturing in the next 6 months, further improving its debt maturity profile.

Financing cost is 14% lower y-o-y in 9M20, at €78m, the lowest of the last few years.

Andreas Shiamishis, Group CEO, commented on results:

“During 3Q20, we faced the most adverse industry environment in history. Already many refineries in the region have reduced utilization, while some are curtailing or terminating activities. Despite the partial recovery of the world economy vs 2Q20, the fuels market remains at significantly lower levels, as the pandemic affects tourism and travel in general. Operating environment remains challenging, with the health and safety of our employees, as well as the uninterrupted operation of the supply chain, being top priorities.

In this environment, we managed to sustain our production at high levels, increasing our exports, while taking advantage of the international market opportunities, in order to mitigate, to the extent possible, the negative impact.

The safe and successful completion of the turnaround program of our largest refinery in Aspropyrgos, which was a demanding project, due to the very large scale of works in a short time frame and the additional health and safety challenges due to COVID-19, was particularly important for us. On behalf of the Management, I would like to congratulate all the colleagues that were involved. The full restart of the refinery in the coming days will result in improved financials and environmental performance.

In terms of strategy implementation, we took important steps in relation to the large RES project in Kozani. We completed the acquisition and secured funding with especially favorable terms and the tangible support of international capital markets and the EBRD.

At the same time, we continued and increased our contribution towards facing the pandemic, especially in terms of supporting the National Health System, with notable increase of the testing capacity, as well as strengthening the ICU system.

The environment is expected to remain difficult in the coming months, with expectations for a substantial improvement after mid-2021. The fragile recovery in the oil market is not enough to return to previous levels and our objective remains to effectively manage the Covid-19 impact on our activities and performance in the best possible way. At the same time, despite the structural issues in the energy market, we intend to take advantage of this period to implement our growth plans to cleaner energy, as well as to accelerate the digital transformation in our activities, in order to improve the Group’s position in the future.”

Key highlights and contribution for each of the main business units in 3Q20 were:

REFINING, SUPPLY & TRADING

- Refining, Supply & Trading 3Q20 Adjusted EBITDA at €17m.

- Production amounted to 3.3m MT (-14%), due to the Aspropyrgos shut-down. Sales amounted to 3.7m MT, with exports up 10%, at 2.2m MT, partly offsetting domestic market decline.

- Crude mix was driven mainly by the new IMO operating model at Aspropyrgos, while white products yields exceeded 90%.

PETROCHEMICALS

- Adjusted EBITDA amounted to €15m (-24%) in the 3Q20, due to reduced propylene output at Aspropyrgos during maintenance, as well as weak PP benchmark margins.

MARKETING

- In Domestic Marketing, the significant drop in aviation and bunkering fuels and the demand decline due to lower tourism in the country, led sales volumes and profitability lower, with 3Q20 Adjusted EBITDA at €17m (-50%).

- In International Marketing, good operating performance resulted in limiting the impact of the pandemic in terms of volumes and contribution, with 3Q20 Adjusted EBITDA at €17m (-16%).

ASSOCIATED COMPANIES

- DEPA Group contribution to 3Q20 consolidated Net Income amounted to €4m.

- Elpedison's EBITDA for the 3Q20 came in at €15m, with 9M20 at €43m, a notable increase vs last year, due to supply mix optimisation.