6 minutes

6 minutesFY21 operating results improvement, implementation of the Group’s key strategic initiative Vision 2025

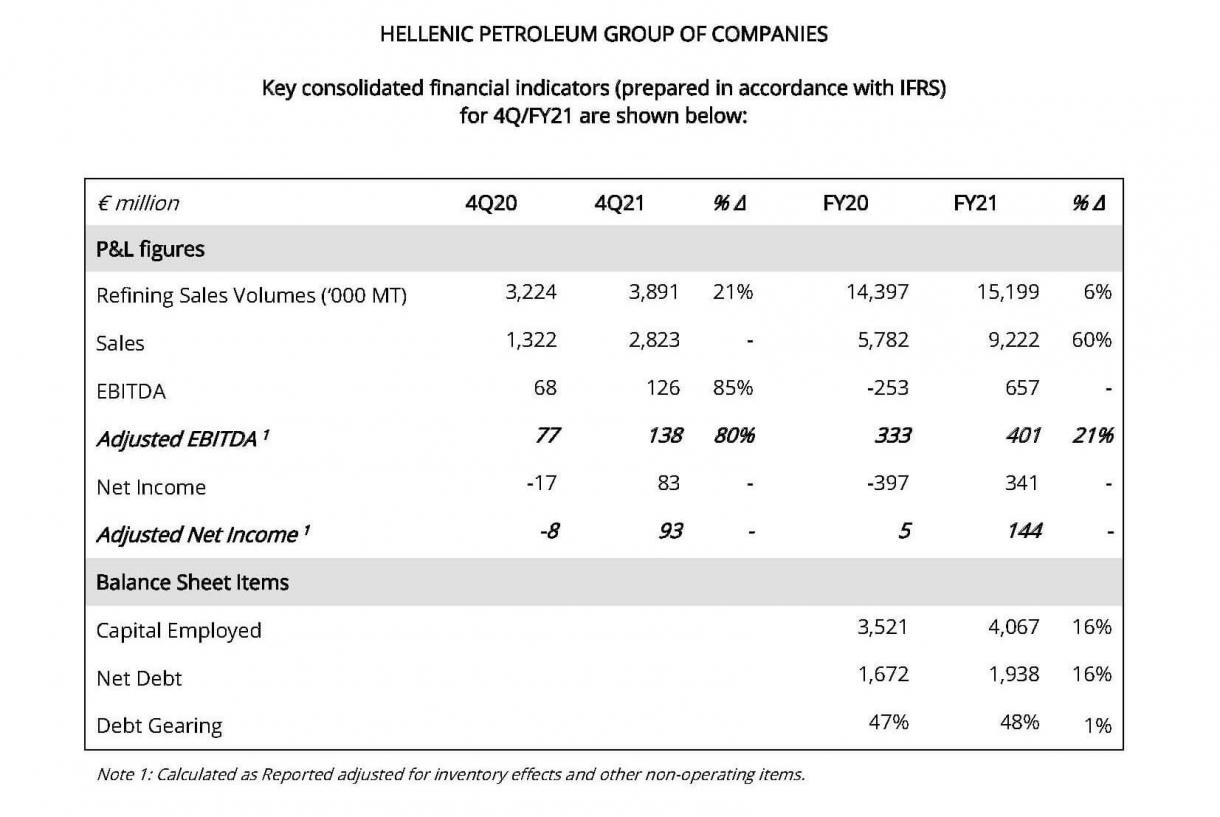

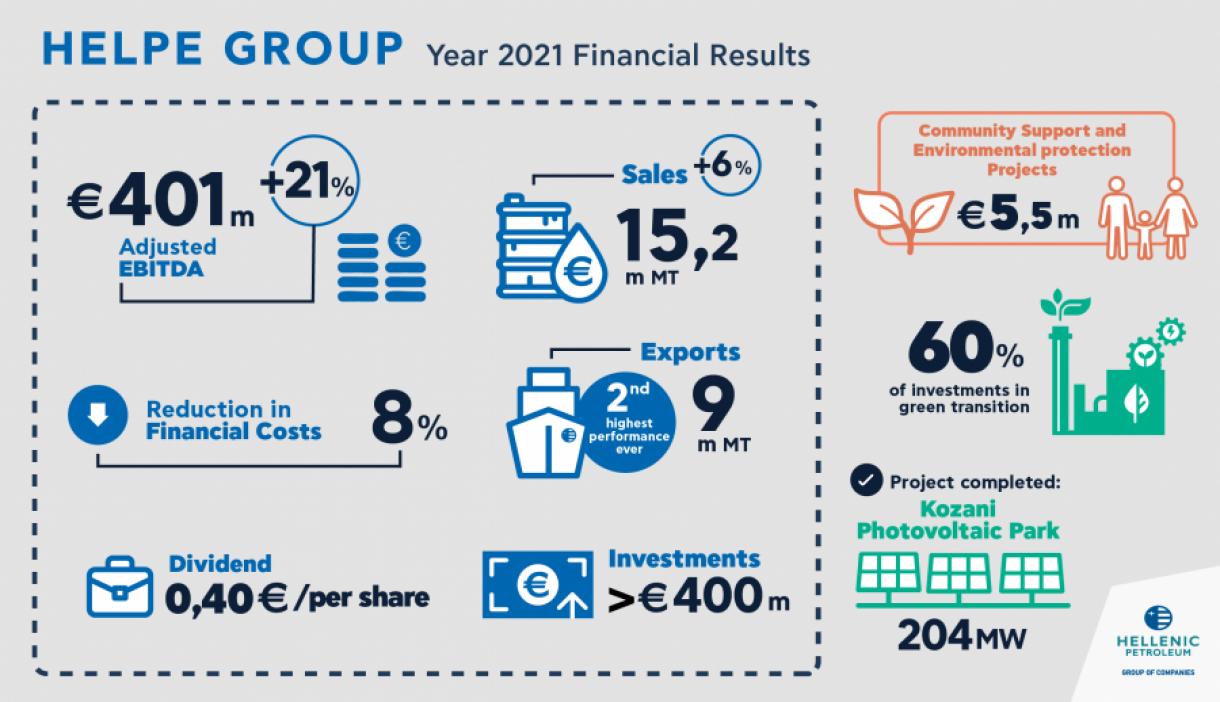

HELLENIC PETROLEUM Holdings S.A. announced its 4Q/FY21 consolidated financial results, with Adjusted EBITDA coming in at €138m in 4Q, +80% vs last year, while FY21 Adjusted EBITDA amounted to €401m (+21%) and Adjusted Net Income to €144m.

The results improvement was achieved in a weak economic environment in terms of demand and benchmark refining margins in 1H21, as well as the global energy crisis in 2H and was driven mainly by increased production and exports of refined products and the overall positive performance of the international subsidiaries. Production and sales of oil products increased to 14.4m MT (+4%) and 15.2m MT (+6%) respectively, with exports at their second highest level in the Group’s history. Petchems captured the improved international environment and recorded a historical high in terms of profitability at €131m, while Domestic and International Marketing considerably improved their contribution, as markets gradually recovered, despite higher operating costs.

The Reported Net Income in 2021 amounted to €341m, the second highest in the history of the Group, reversing last year’s losses of €397m, as crude oil prices recovered significantly from the historical lows recorded in 2020.

The Board of Directors, considering the results and outlook, decided to proceed with the distribution of dividends of €0.40/share; €0.30/share will be distributed in April and €0.10/share after the AGM.

Strategy Implementation – Vision 2025

During the year, the Group proceeded with the update and implementation of its new strategy “Vision 2025”, an ambitious plan targeting improved operations of the Group and the strategic shift towards green energy.

The corporate governance framework was significantly upgraded with the election of the majority of the Board of Directors members by the General Assembly and increase of independent members, the implementation of a fit & proper policy and a minimum gender quota in accordance with the Law 4706/2020 and by incorporating improved practices at European level.

Furthermore, in 3 January 2022 the corporate restructuring was successfully completed with the demerger by way of hive-down of the Group’s refining, supply and trading of oil products and petrochemicals sector and the establishment of a new company, 100% subsidiary of HELLENIC PETROLEUM, which was renamed to “HELLENIC PETROLEUM Holdings S.A.”.

In 2021, the implementation of Group’s investment plan accelerated, with capital expenditure reaching €400m, mostly on green transition projects, which represent almost 60% of the total capex for the year. Specifically, the construction phase of 204MW photovoltaic park in Kozani was completed, with the connection and start of operations expected in 1Q22. In addition, in 4Q21, the Group proceeded with the acquisition of operating wind parks, with total installed capacity 38MW and particularly high load factors, while during 1Q22 completed the acquisition of 16MW operating PV parks. The above will enable the achievement of the target of 300MW installed capacity in operation in early 2022, earlier than the initial target.

The sale of DEPA Infrastructure (65% HRADF – 35% HELLENIC PETROLEUM Holdings) to Italgas for €733m, which corresponds to €256m for the participation of HELLENIC PETROLEUM Holdings, is expected to be completed in the near term, following relevant regulatory approvals. It should be noted that 50% of the proceeds will be allocated to an extraordinary dividend to the shareholders.

Recovery of crude oil prices to the highest levels since 2014, strengthening of international refining margins

International crude oil prices increased in 2021, following the multi-year lows of 2020, due to the recovery of economic activities, easing of mobility restrictions to mitigate COVID-19 and the normalization of travel activity. Increased demand, together with the proportionally lower supply growth from OPEC++, led to higher prices. As a result, Brent prices in 4Q21 reached $80/bbl, a seven-year high, compared to $44/bbl in 4Q20. Prices followed a similar trend throughout the year, with Brent price averaging at $71/bbl, 68% increase compared to 2020.

The dollar strengthened against the euro averaging 1.14 in 4Q21 while for FY 2021 the euro averaged 1.18 dollars (1.14 in 2020).

In 4Q21 diesel cracks recovered reaching two-year highs, leading to improved Hydrocracking benchmark margins q-o-q to $5/bbl, while FCC refining benchmark margins reached $5.2/bbl.

Increased demand in domestic fuel market

Total demand in the domestic market for ground fuels was 1.5% higher, reaching 6.4m MT, while the consumption of auto-fuels increased by 6.6% in 2021, as a result of the lifting of mobility restrictions, in contrast with heating gasoil which decreased 17% due to milder weather conditions. Aviation fuels increased significantly by 90% due to the increase of tourist traffic and bunkering fuels grew by 7.2% due to increased coastal shipping activity.

Finance Cost at historical lows

During 4Q21, the Group repaid the €201m Eurobond, with 4.875% interest rate, which had a substantial positive effect on the finance costs, which amounted to €23m, lower by 13%. For the year, the total finance costs amounted to €96m (-8%), recording a decrease of more than 50% over the last 5 years. Net debt reached €1.9bn, with gearing ratio at 48%.

Andreas Shiamishis, Group CEO, commented on the results: “2021 was a milestone year for HELPE, as we progressed significantly in areas that redefine our strategy and our transformation towards a greener energy group. Through a holistic plan, Vision 2025, the modernization of the corporate governance framework and the successful completion of the corporate restructuring and shift of strategic emphasis towards the development of green energy, with unanimous acceptance from the market, the shareholders, the bondholders, the creditors, as well as the support from management. Through this program, the Group will continue to play a leading role in the energy market, aiming at improving our environmental footprint by 50% by 2030, as well as the gradual transition towards greener energy sources and more environmentally-friendly fuels.

In this context, with total 2021 capital investments of €400m, out of which 60% relate to developing green energy, while an additional 10% directed to environmental upgrading and safety projects in our facilities, we are accelerating towards the implementation of this plan. Already, the fact that within the year we have upgraded our portfolio with 0.3 GW RES in operation, out of which 0.2 GW were recently completed and is the largest RES investment in our country, demonstrates that the Group has the ability to move swiftly and decisively in this sector.

In relation to financial results, the improvement of our operational performance and profitability, with increased production and exports in a challenging international environment, is the result of the continuous effort to enhance our competitiveness. Increased emphasis is given to digital transformation, for which a long term, aspiring plan is in progress, focusing on organizational flexibility and international trading growth. The above enable us to proceed to a dividend distribution of total amount of €0.40 / share and, as we committed, 50% of the expected proceeds from the sale of DEPA Infrastructure will be distributed as an extraordinary dividend during 2022.

Finally, besides from our strategy and our financial results, particular emphasis has been given to environmental and social contribution issues, through a series of targeted initiatives mainly around local communities but also through one of the largest private programs of environmental protection and restoration in areas affected by the recent wildfires of 2021.

All the above achievements were made possible with the significant effort of all Group employees, who successfully managed all the challenges and I would like to personally thank them for their substantial contribution.”

Key highlights and contribution for each of the main business units in 4Q/FY21 were:

REFINING, SUPPLY & TRADING

- Refining, Supply & Trading 4Q21 Adjusted EBITDA at €86m (+99%).

- Net production amounted to 3.7m MT (+24%), with sales at 3.9m MT (+21%), with FY21 at 14.4m MT and 15.2m MT respectively.

- Realised HELPE System margin came in at $11.8/bbl in 4Q21, with significant overperformance vs benchmarks.

PETROCHEMICALS

- 4Q21 Adjusted EBITDA came in at €28m, almost tripling vs 4Q20, as the strong polypropylene margins and the increased production of propylene in the Aspropyrgos refinery had a positive effect on the profitability, while FY21 recorded the highest historical performance in terms of operating results at €131m.

MARKETING

- In Domestic Marketing, the gradual recovery of the market, together with the increase of market shares and the successful introduction of differentiated fuels in the retail network, led to significantly improved results for 2021, despite the increased supply chain costs, 4Q21 Adjusted EBITDA at €9m and FY21 at €58m (+52%).

- In International Marketing, the recovery of demand in all countries resulted in increased sales volumes, which mitigated the higher operating expenses in most markets and led to improved profitability for 2021, with 4Q21 Adjusted EBITDA at €16m and for FY21 at €62m (+5%).

ASSOCIATE COMPANIES

- DEPA companies’ contribution to the consolidated net income for FY21 was €68m.

- Elpedison EBITDA amounted to €94m in FY21 due to the increased demand for electricity and the increased production of Elpedison plants