4 minutes

4 minutesPositive results on increased production and exports, despite weaker benchmark refining margins

Strong operational performance in Refining, Supply & Trading, the Group’s main activity, as well as increased exports led 3Q16 HELLENIC PETROLEUM Group Adjusted EBITDA at €191m, despite the considerable decline of benchmark refining margins, compared to last year. Reported EBITDA for 3Q16 amounted to €190m, 74% higher vs 3Q15.

Group refineries reported a 19% production growth, at 3.9m MT, the strongest performance on record, fully capturing the high mechanical availability of units, recording overperformance vs benchmark margins. Petchems reported another quarter of Increased sales, sustaining contribution at high levels, despite weaker international margins. In Fuels Marketing, domestic retail market share growth and higher sales in most activities sustained.

Strong operational performance and relative stability in crude oil prices, led 3Q16 Group Net Income to €80m, 110% higher vs 3Q15, with 9M16 Group Net Income to €184m, the highest in the last few years and up 76% vs last year.

Stable crude oil price, weaker benchmark margins

During 3Q16, supply/demand balances, combined with expectations about OPEC’s intention to adjust production, maintained crude oil prices on average at the same levels with 2Q16, at $47/bbl.

Despite higher crude oil supply in the Med, underpinned by Iran’s return to international markets and its significantly higher exports in the region, products oversupply led Med benchmark refining margins lower by approximately 36% vs last year, with FCC margins averaging $4.6/bbl ($7.3/bbl), with Hydrocracking margin at $4.0/bbl ($6.2/bbl).

Increased domestic fuels demand

Domestic fuels demand, according to official market data, was higher by 8% in 3Q16, with total consumption volume at 1.6 million tones, reversing the respective decline recorded in 3Q15, following the imposition of capital controls. Increased tourism supported Aviation & Bunkering market, which also grew by 6% in 3Q16.

In 9M16, total domestic fuels demand was unchanged vs last year, at 5m MT.

Record sales and exports, further diversification of crude sourcing

The increased production of the complex and upgraded Group refineries, led to increased sales by 20%, at (4.388k MT), with exports 45% higher at 2.459k MT, a new record high, highlighting Group’s export orientation.

Furthermore, the implementation of commercial agreements with national oil companies and increased liquidity enabled the diversification in the crude grades and supply terms, as well as realization of additional commercial opportunities in the Med region, with a positive effect on financial results and crude supply risk management.

Successful issue of the new €375m bond reduced interest cost and improved financial risk management

The Group continued the implementation of its financial strategy, with the issue of a new 5-year, €375m Eurobond, maturing in October 2021, with a 4.875% coupon. Significant part of the demand came from existing noteholders, which participated in the tender offer for the 8% May 2017 Bond, which ran in parallel with the new issue, with noteholders in excess of €200m opting to participate to new bond. Furthermore, demand from new investors was strong, significantly oversubscribing the offering, resulting to the upsize of the issue and the tightening of the final yield compared to initial price talk.

Lower finance costs, strong operating cash flows

The new bond issue and tender offer, combined with the material improvement in terms and definitions of bonds and bank facilities, as well as the repayment and refinancing of €1.5bn of borrowings during 2016, improved Group’s capital structure and extended maturity profile; furthermore, finance cost is reduced by €15m from 2017, as the new notes have significantly lower interest cost (4.875% vs 8%).

Operating cash flows (Adjusted EBITDA – capex) for 9M16 amounted to €435m, at the same levels as last year, despite lower benchmark margins. High profitability, combined with stronger capital structure led Net Debt to €1.8bn, significantly lower vs last year (3Q15: €2.4bn).

Key strategic developments

On 28 October, following an international tender process, the JV of TOTAL – EDISON – HELLENIC PETROLEUM was announced as preferred bidder for the award of hydrocarbons exploration and exploitation rights in offshore “block 2” in NW Ionian Sea.

Regarding the sale of 66% of DESFA share capital to SOCAR, the parties agreed to extend the long-stop date for the completion of the transaction to 30 November 2016.

Furthermore, on 31 August, the merger of “HELLENIC FUELS SA” and “EKO SA”, was successfully completed through the absorption of the latter from the former.

Key highlights and contribution for each of the main business units in 3Q16 were:

REFINING, SUPPLY & TRADING

Highest quarterly production ever

- Refining, Supply & Trading 3Q16 Adjusted EBITDA at €124m, (2Q15: €166m)

- Production amounted to 3.9 million tonnes, the highest quarterly performance on record with sales at 4.3m tonnes, while exports at 2.5m MT, represent 57% of total sales.

- White products’ yield at 84%.

PETROCHEMICALS

Higher production and sales

- Higher PP production and sales volumes (+16%), maintained profitability at high levels, with Adjusted EBITDA at €25m, despite the decline in benchmark margins.

MARKETING

Increase in market shares

- Marketing Adjusted EBITDA in 3Q16 amounted to €44m, vs €47m LY.

- Market share gains in retail, aviation and bunkering continued. Domestic Marketing profitability, with Adjusted EBITDA at €26m, was negatively affected by the effect of Platt’s prices evolution on international aviation sales pricing formula.

- International Marketing was impacted by lower margins in the Bulgarian market and weak volumes in Serbia, with Adjusted EBITDA at €18m.

ASSOCIATED COMPANIES

- DEPA Group contribution to consolidated Net Income came in at €9m, with higher volumes, as demand from gas-fired electricity generators increased notably.

- Elpedison EBITDA at €16m on higher production and implementation of the flexibility remuneration mechanism from May 2016.

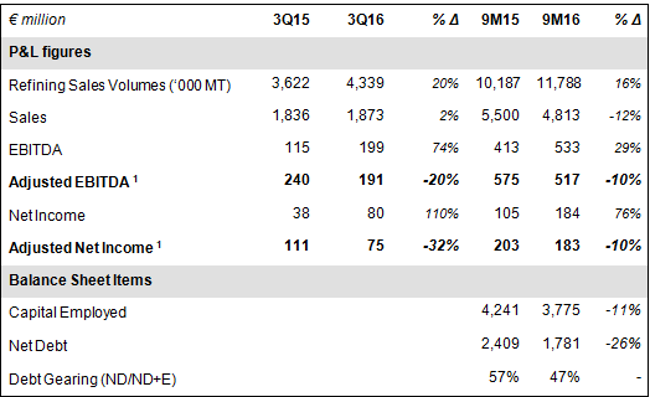

Key consolidated financial indicators (prepared in accordance with IFRS) for 3Q16 are shown below:

Notes:

1. Calculated as Reported adjusted for inventory effects and other non-operating items.

Note to Editors:

Founded in 1998, Hellenic Petroleum is one of the leading energy groups in South East Europe, with activities spanning across the energy value chain and presence in 6 countries.

Further information:

V. Tsaitas, Investor Relations Officer

Tel.: +30-210-6302399

Email: [email protected]