5 minutes

5 minutes

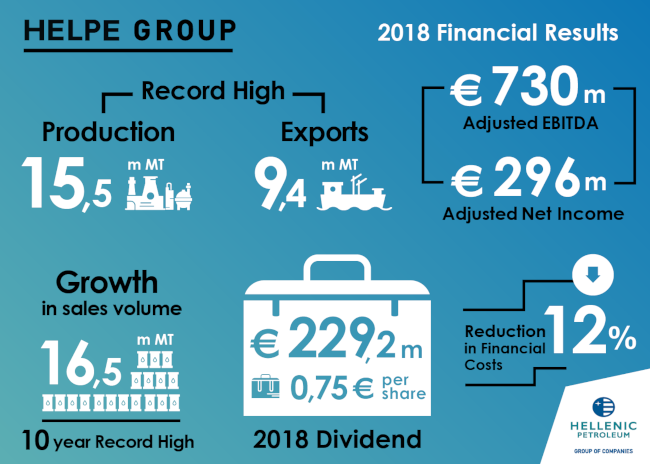

Strong profitability on record production and higher exports sales, despite weaker benchmark refining margins. Positive results and improved balance sheet led to a BoD proposal for a FY 18 dividend of €0.75/share (€229m)

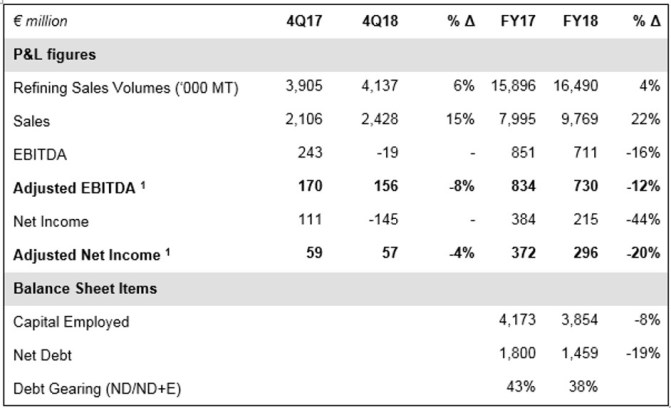

HELLENIC PETROLEUM Group announced its 4Q and FY18 financial results. FY Adjusted EBITDA came in at €730m (-12%), with Adjusted Net Income at €296m (-20%). The Group delivered a strong set of results, as improved refineries mechanical availability and production during 2018 vs last year, partly offset the expected profitability drop due to refining environment deterioration, as evidenced by weaker Med benchmark margins and a stronger euro.

During a year which ranks as one of its best ever in terms of refining performance, the Group recorded historical highs in production and sales at 15.5m MT (+3%) and 16.5m MT (+4%) respectively, while exports grew even further at a record high of 9.4m MT, making the Group as one of the largest exporters in the country.

In terms of Reported IFRS results, Net Income amounted to €215m (-44%), reflecting the losses suffered on inventory valuation in 4Q18 due to the oil price drop, as well as a number of one-off non-operating accounting provisions. These include the impairment on the sale of DESFA, provision for deferred tax liability on the sale of DEPA, mark to market of provisions for CO2 emission rights prices, as well as other non-operating provisions.

On the back of strong results, prudent financing strategy and the completion of the sale of its stake in DESFA to “SENFLUGA Energy Infrastructure Holdings S.A.”, for a cash consideration of €284m, the Group reports an improved balance sheet and a lower cost of financing.

In addition to positive operating results, during 2018 senior management focused on strategic priorities, setting the pillars for a new competitiveness improvement program. In that respect, the Group launched initiatives that will form part of its strategy for the coming years in the areas of digital transformation, energy efficiency and CO2 emissions reduction, procurement optimization (BEST) and growth in renewables.

Considering FY18 results, the stronger balance sheet, as well as the positive 2019 outlook, the BoD has approved a proposal to the AGM for a final FY18 dividend of €0.5 / share, taking the total 2018 dividend to €0.75 / share (€229m); out of the total dividend, €0.25 / share corresponds to a special distribution from DESFA sale proceeds, while the balance of the proceeds will be used for debt and finance cost reduction.

Significant crude oil price drop in 4Q18

Crude oil price recorded a considerable decline in 4Q18, averaging $68/bbl, with increased volatility, ranging between $50-85/bbl, on increased production, mainly in US, as well as a slow-down in global demand growth. In FY18, Brent oil prices increased materially, averaging $72/bbl.

The notable decline in gasoline cracks has negatively affected Med benchmark FCC margins, that recorded a 13% drop, averaging $4/bbl, while stronger diesel cracks led Med hydrocracking benchmarks at $5.3/bbl, flat y-o-y. Equally, in FY18, FCC benchmarks averaged $5.0/bbl (-16%), with Hydrocracking margins at $5.5/bbl (+5%).

USD strengthened further in 4Q18, with euro averaging $1.14, while for FY18 the euro was stronger vs 2017, at $1.18.

Auto fuels marginally higher. Aviation and marine fuels growth continued

Domestic fuels demand was 6.7 m tones, -3% vs 2017, as heating gasoil consumption declined. Contrary, auto-fuels demand recorded a small growth. Aviation fuels consumption amounted to 1.3m MT (+11%), registering an increase for the 6th consecutive year, with marine fuels also up by 4% at 2.9m MT.

Finance strategy objectives achieved, stronger balance

Financing costs in 2018 at €146m, recorded a cumulative drop of 32% in the last 4 years, as a result of positive performance and the successful implementation of the Group’s financial strategy, with refinancing of bank loans and eurobonds at improved cost and terms. During 2018 the refinancing of bank loans totaling €900m was completed with significant benefits in cost, maturity and flexibility.

Operating cash flows (Adjusted EBITDA – Capex) were maintained at high levels in 2018, at €572m and combined with DESFA sale proceeds, led Net Debt at €1.5bn and gearing at 38%, the lowest in the last 9 years, within the target range of Group strategy.

Important developments

In E&P, the planned environmental studies and exploration activities at Patraikos Gulf continued in 4Q18, while respective works have commenced at offshore “Block 2”, as well as onshore “Arta-Preveza” and “NW Peloponnisos”.

Regarding the restructuring of DEPA activities, the acquisition of remaining 49% of EPA and EDA Attikis from Attiki Gas (subsidiary of Shell Gas BV) was completed, following regulatory approvals; together with the sale of EPA Thessaloniki and DESFA, the position of DEPA Group in Distribution and Retail is clarified.

Key highlights and contribution for each of the main business units in 4Q/FY18 were:

REFINING, SUPPLY & TRADING

- Refining, Supply & Trading 4Q18 Adjusted EBITDA at €125m (-4%), with FY18 at €548 m (-14%).

- 4Q18 sales volumes were 6% higher at 4.1m MT, despite a small decline in production.

- The Group continues its preparation ahead of new marine fuel specs change in 2020, in order to respond to market conditions. In that respect, new types of US crude oil were successfully tested at Aspropyrgos refinery, further differentiating crude slate.

PETROCHEMICALS

- Higher vertical integration between Aspropyrgos refinery splitter unit and Thessaloniki petchems plant, as well as increased sales, led to improved operating profitability for Petchems, with 4Q18 Adj. EBITDA at €22m (+9%).

MARKETING

- FY18 Marketing Adjusted EBITDA at €93m (-13%).

- In Domestic Marketing weaker heating gasoil demand, as well as inventory losses due to the considerable oil price drop, negatively affected contribution to Group results, with 4Q18 Adjusted EBITDA at €2m (-79%).

- In International Marketing a 4% increase in sales partly offset weak margins in Balkan markets, that led 4Q18 Adjusted EBITDA to €10m (-19%).

ASSOCIATED COMPANIES

- DEPA Group participation to 4Q18 consolidated Net Income, adjusting for the impact of DESFA sale, came in at €7m.

- The reinstatement of a flexibility remuneration mechanism for gas fired generators had a positive impact, with Elpedison 4Q18 EBITDA at €15m (+11%), despite higher cost for nat-gas and CO2 emission rights.

Key consolidated financial indicators (prepared in accordance with IFRS) for 4Q/FY18 are shown below:

Notes:1. Calculated as Reported adjusted for inventory effects for Refining, Supply & Trading and other non-operating items.

Further information:

V. Tsaitas, Investor Relations Officer

Tel.: +30-210-6302399

Email: [email protected]