3 minutes

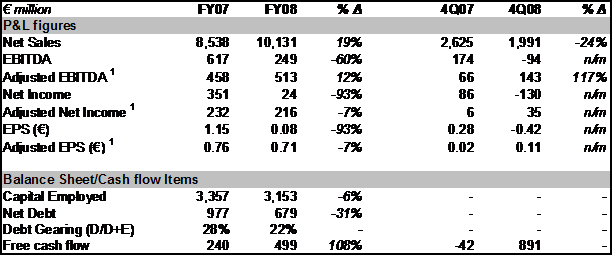

3 minutes• FY08 adjusted EBITDA at €513m (FY07: €458m), up 12%

• FY08 adjusted Net Income at €216m (FY07: €232m), down 7%

• 4Q08 adjusted EBITDA at €143m (4Q07: €66m), up 117% y-o-y

• 4Q08 adjusted Net Income at €35m (4Q07: €6m)

• FY08 adjusted Net Income at €216m (FY07: €232m), down 7%

• 4Q08 adjusted EBITDA at €143m (4Q07: €66m), up 117% y-o-y

• 4Q08 adjusted Net Income at €35m (4Q07: €6m)

2008 in brief:

Hellenic Petroleum delivered strong operating profitability in 2008, due to improved performances in Refining (on better margin realisations and an improved sales mix) and in Power generation. In Marketing, the restructuring of the domestic network footprint and the expansion in the Balkans continued, while operating profitability was essentially flat y-o-y. In terms of volume sales, the Greek market in total is holding up well in the face of the current economic downturn and we managed to gain market share. In turn, volumes continued rising in the Balkans, despite a slowdown in the growth rate in the last quarter of the year.

Reported results were affected by €482m in inventory losses (2007: inventory gains of €159m) due to the unprecedented drop in oil prices in the 2nd half of the year.

The contribution to group Net income from the 35%-owned DEPA more than doubled y-o-y to €55m (2007: €24m), due to increasing demand for natural gas and higher margins.

Finally, the group generated €500m in free cash flow (2007: €240m), lowered gearing levels to 22% (2007: 28%) and maintained a strong balance sheet.

Taking into account the Group’s prospects, future capex plans and cash flow position, the Board of Directors proposes a total (ie including the interim dividend of €0.15 paid out in 2008) FY08 dividend of €0.45 per share (2007: €0.50).

4Q08 in brief:

The 4th quarter of 2008 was marked by strong operating profitability in Refining, where adjusted EBITDA increased by 236% to €131m (4Q07: €39m) on higher margins and tight cost controls, as well as €15m in gains from our transformation initiatives.

Domestic Marketing was hit by the sharp drop in refined product prices that adversely impacted inventory valuation. The worsening global macro backdrop hit profitability in Petrochemicals, with sharply lower demand and margins.

Reported profitability was affected by a number of non-operating items. On the one hand, results were boosted by the €138m gains from the restructuring of our E&P portfolio and the €53m gains resulting from the completion of the joint venture agreement with Italy’s Edison in Power Generation & Trading. However, reported results were also affected by €428m in inventory losses (4Q07: inventory gains of €107m) due to the sharp drop in oil prices.

Finally, free cash flow generation amounted to almost €900m (4Q07: -€42m), driven by lower oil prices and a tighter working capital management, plus the cash receipts from our E&P transactions.

Commenting on the results, CEO John Costopoulos mentioned:

“Within a year of unprecedented financial turmoil and volatility, Hellenic Petroleum achieved improved operating profitability as a result of strong refining margin realisations, continued operational improvements and a good overall performance in our non-refining business units. FY08 adjusted EBITDA increased by 12% to €513m, and our free cash flow generation doubled y-o-y to €500m. However, full year reported profitability suffered from the particularly sharp drop in international oil prices in the second half of the year, which resulted in a €482m loss on stock devaluation.

In addition, in 2008 we delivered on a number of value-adding strategic initiatives, namely the restructuring of our E&P asset portfolio, the completion of the agreement for a strategic alliance with Italy’s Edison in Power Generation and Trading, and we advanced our performance improvement programme. In total, these initiatives added over €200m to the Group’s FY08 pre-tax earnings.

Regarding 2009, the start of the year has witnessed strong refining margins and stable volumes. However, we remain cautious over the weakening global economic conditions and their effects on the markets in which we operate. With the macro environment toughening, we are committed to our long-term strategy of profitable growth and competitiveness. We remain focused on driving through further operational efficiency gains and on our investment programme to upgrade our refineries at Elefsina and Thessaloniki, with projects proceeding within the planned time-frame and budget. At the same time, we are tightening cost controls and working capital management, and are applying more stringent discipline on risk management and capital expenditures.”

Key Financial Indicators for the Group are shown below:

HELLENIC PETROLEUM

CONSOLIDATED KEY FINANCIAL RESULTS FOR THE THREE-MONTH AND TWELVE-MONTH PERIODS ENDING 31 DECEMBER 2008

(Prepared in accordance with IFRS)

(Prepared in accordance with IFRS)

Note 1: Adjusted for inventory effects and other non-operating items